This is the first part of a series investigating the true ownership of New South Wales.

Time travel is a fascinating concept. People often look back on situations they regret and remark how they wish they could go back in time and do things differently. Others often fantasize about the ability to travel forward in time for a sneak peek at their future life or in my case a look at next week’s Powerball numbers. Unfortunately though, it seems time travel in this sense will never become reality and to be quite honest I could take or leave the more plausible and logical far less cool theory. Fortunately Hollywood has never been one to allow facts to get any near, let alone in the way of a good story and continues to whet our appetite for our futuristic fantasy.

It’s not just for sci-fi buffs either. Some of the most popular movies ever made featuring characters zipping back and forth throughout the ages. In fact, arguably the greatest love story ever told relates to a bloke who travels back in time to punch on with himself over love. Spare me your notebooks and sinking ships people, it does not get any more romantic than that! (In case anyone was wondering, I’m obviously referring to 2012s “Looper” starring Bruce Willis and Joseph Gordon-Levitt). But when it comes to the time travel genre there is nothing bigger than James Cameron’s epic, then shit, then epic again Terminator franchise. The Terminator series features robots being sent back in time to modern day Los Angeles to kill and/or protect members of the poor old Connor family and save us all from the war against the machines and Judgement Day.

If only we could have had a muscular Austrian accented cyborg with political aspirations to come back and save us from our own war against the machines. I would have been sending him back to San Francisco in the late 1800’s to visit a gentleman by the name of Charles Fey. Then a little pop in to Sydney in the 1950’s and 60’s just in make sure Len Ainsworth and Joe Heywood weren’t up to no good. Unfortunately we don’t have our own terminator (yet), Judgement Day has been and gone and the war with the machines is over. The result is not in question – we lost. The real question here is specifically, who won?

Pokie machines have long been considered a cancerous scourge on society, preying on the mentally weak to relieve them of their hard earned pay cheque or relatively easy welfare payment. In almost every pub in the state you will hear their incessant chirping accompanied by the repetitive thud of another loser coward punching the “spin” button over and over again expecting riches at first, the rent back later and a bus home by the end. They used to often be found in dingy, depressing corners of pubs known as “VIP Rooms”, a title at odds with their occupants and general purpose. They were easy enough to avoid unless you were in a certain mood or state and just keen to do your arse. But whether you were using them or not, you could always feel the omnipresence of Cleopatra, Queen of the Nile.

However years ago that changed. The Nanny State, in their endeavour to outlaw smoking made the benevolent and wise decision to combine smoking areas with pokie rooms, or as they soon came to be known, “smokie pokies”. In the governments quest to tackle the massive public health issue of smoking, they decided to tax the shit out of tobacco with the result being pretty much nobody quit for that reason, and their own coffers filled up quicker than one could say “we’re gonna need bigger coffers”. Mission accomplished, or so you’d think. Not content with ripping smokers off to their face, a further kick to the teeth was coming.

Smokers no longer had the right to puff away wherever they pleased in licensed venues. Even as a smoker I have to say this was a 100% fair call. But while some venues had tiny but designated areas for smokers, many others the area was the pokie room / space. I can only assume the logic here was if smokers were choosing to accept being stolen from at the 7/11 counter, another option had to be pursued to relieve them of their cash. Forcing them into the pokie room made perfect sense. Either way whether it be from smoking or gambling the cash was ending up in the same place. If this all sounds quite familiar it’s because it’s been happening again to a different market more recently via the lockout laws. Once again the government is giving the people no other option but to be in the presence of these insidious machines.

Politicians have long been slaves to the dirty dollars their computerised commanders bring in. This is certainly not a new revelation. It’s common knowledge that New South Wales is home to almost 100 thousand machines, far more than Vegas or anywhere else in the world for that matter. Annual pokie machine turnover in New South Wales is at almost one hundred billion dollars. In 1999 the Australian Productivity Commission Report published findings putting the number of severe problem gamblers at 130,000 with those gamblers making up 33% of industry revenue. It was in this report that experts referred to pokies as the “crack cocaine of problem gambling”. Interestingly in the 2010 Productivity Commission Report that figure was estimated at “between 80,000 and 160,000”. I find the likelihood that the number has dropped in the age of betting apps, live sports betting, online poker, etc.

It’s hardly ground breaking news that the so called gaming industry is massive and therefore influences the actions and behaviour of many. I mean, who could ever forget Dr Gordian Fuldes now infamous suggestion to “go to the casino”. What is quite shocking though, is the true magnitude of the machine takeover. Especially some of the individuals and organisations who have aligned themselves with the cyborg revenue collectors, and to what extent. Which is what we will be exploring over a few articles starting with this being the first.

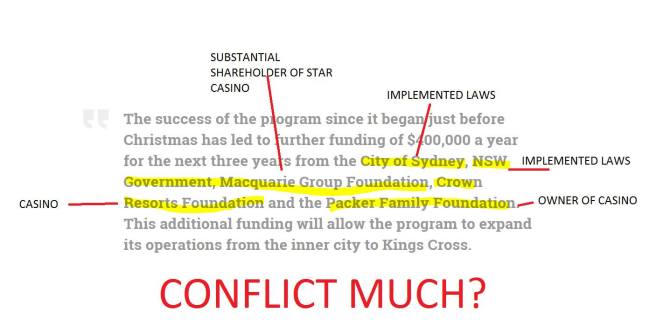

Over the past couple of months Surely Not has been publishing various parts of an investigative story about the Thomas Kelly Youth Foundation, their relationship with casino interests, profiteering and all the other dodgy shit that has yet to be explained. Astute readers would have noticed another member of what is increasingly looking like a modern day Kelly Gang. Along with Ralph Kelly and his right hand man Dr Fulde, is the third founding director – Macquarie Bank executive director Guy Reynolds. Mr Reynolds was there at the start, he was there after three other directors inexplicitly left within a month of each other and he’s still there now. He recently came out in staunch defence of his pal Ralph when his obscene salary was publicised. Unfortunately, like Ralph, Guy also failed to provide any actual clarity on this subject and many questions remain unanswered.

It’s not known if Ralph and Guy were old mates from back in the day. Google does not yield any results here. So his motivations for becoming a founding director are unclear at this stage. However what most certainly is not unclear is his employer’s interest in becoming involved with such a racket.

It may seem obvious that as an investment bank, Macquarie would have an interest in lucrative markets such as casinos and gaming. After all, they are in the business of making money, and when the house always wins gambling interests are more or less sure things.

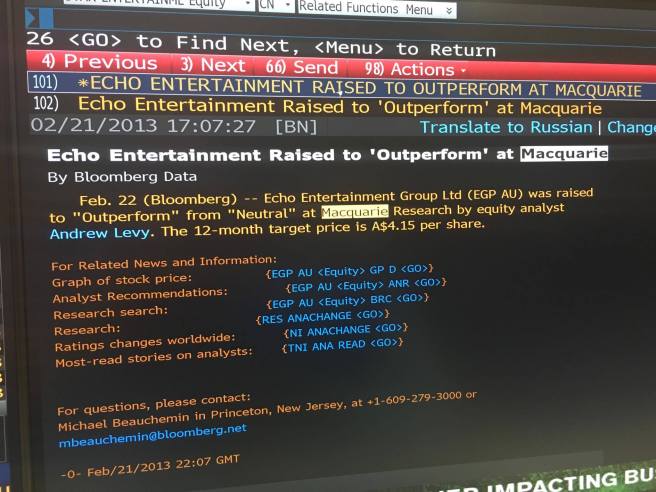

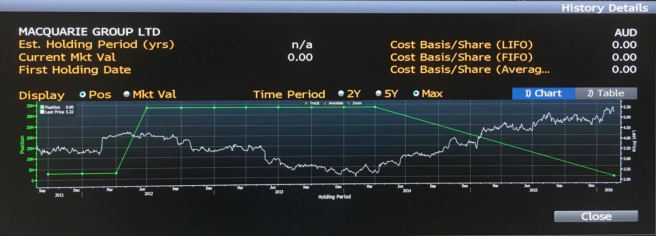

When TABCORP and ECHO de-merged in 2011 it was Macquarie who was in the thick of it, pushing their chips onto the casinos side. It’s been documented that Macquarie Bank are Star Entertainment shareholders. Sydney Morning Herald published an article mid 2012 revealing a 5.1% ownership. Hell, Macquarie themselves called earlier that year that it was a good investment and then backed it up with actions. This figure is backed up by the Echo Entertainment financials from 2012 as well as obtained data regarding Macquarie’s position at that time. Their holding period and position is in the images below. What is extremely interesting to note is what occurs early 2014…

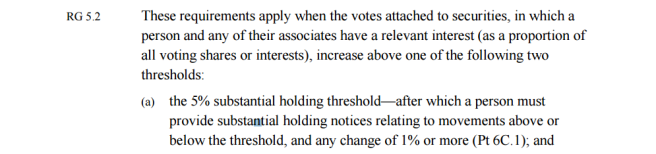

As you can see the green line indicating position turns downward and continues on this way the length of holding period. This is not because they dumped the shares though. Far from it. This data suggests that in the first three months of 2014 Macquarie altered their position ever so slightly to below the 5% mark. What’s so important about the 5% mark? Well, when ownership drops below 5% things get a little grey.

Firstly, an amount less than 5% is considered immaterial and of no great relevance. Details of ownership and position do not have to be revealed meaning one can hold 4.99% in relative anonymity in comparison to one who owns an extra 0.01%. Which is why the line continues downward. It does not mean the position is dropping, it just means there is nothing to publicise. If I was a punting man (and I mean proper punting not rigged casino garbage) which I happen to be, I would wager a fair sum on that line actually levelling out just after it dropped to around the 4.99% mark.

Why would one want this? Ownership below 5% is seen as totally independent. If hypothetically there were multiple any conflicts of interest relating to ownership, by holding a stake below 5% the relationship is considered immaterial. Regardless of whether or not a member of the board was previously Managing Director and CEO of said shareholder…

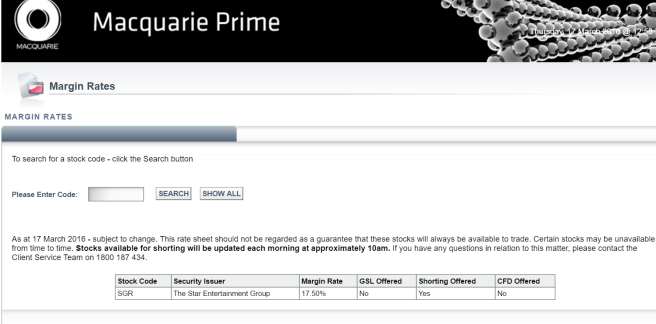

You can read up on all the compliance and regulations here, but to put it simply – you would reduce your position in this way if you had something to hide. Given this move was made early in 2014 around the same time as controversial funnelling lockout legislation was introduced, the financial backing and founding director support of TKYF, the fact they sell Star shares through Macquarie Prime (short and low margin) and a couple of other interests I’m about I’ll be discussing shortly… Well, I’ll let you come to your own conclusions.

Just in case anyone needs a quick refresher, here are just a couple of points we’ve discussed previously…

The point is, as an investment banker, there does not really seem to be any real need to cover up your association with a casino. We get it, you both really, really love making cash and who can begrudge anyone for that? Macquarie happens to be extremely good at it, with their so called “Macquarie Model” yielding billions of dollars as well as the power and influence associated with such wealth. They did not earn the nickname “The Millionaires Factory” for nothing. As for casinos, well their entire business model is legalised robbery so obviously they’re quite good at it to. So why the sneaky manoeuvre? It’s already something many would be aware of, and those who were not aware would assume.

Macquarie has always been extremely enthusiastic, I would even say obsessive about expanding their gaming interests. In fact, I dare say if Owens, Clarke and co could go back in time to when they founded the bank, they would have just built a casino instead! Goldfields House, Circular Quay would have made a pretty amazing spot, I must admit!

However time travel is one of the very rare things money cannot buy so until then they’re just making do with their reality and playing their part. According to the Australian Financial Review that reality currently includes running around town sizing up hospitality assets for their cool friend, which could be another reason to keep their position somewhat ambiguous. Obviously this pursuit is to further their own interests as well that of the Star, but it does seem a little bit George Costanza having a man-crush on Elaine’s cool boyfriend, Tony. Definitely not as lucrative or glamorous as actually being in the game.

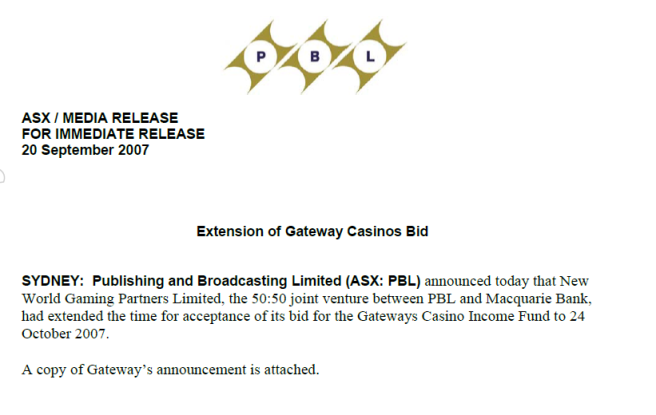

For instance, like the time Macquarie Bank teamed up with James Packer himself to buy no less than nine casinos. Early 2007, months before Publishing and Broadcasting Limited demerged and split into Consolidated Press Holdings & Crown, James Packer set his sights upon North America and began phase one of world casino domination. Phase one was apparently owning every casino in Canada, and with the help of Macquarie that’s exactly what he did. A 50:50 joint venture was formed and their first target was acquired. Personally I feel the name for their new company was an odd choice given long term Packer rival Cheng Yu-Tong established the New World Development Company Limited in 1970, but whatever the inspiration – New World Gaming was born.

Gateway Casinos Income Fund was an entity that owned Gateway Casinos Inc , Star of Fortune Gaming Management and other miscellaneous interests. Basically a portfolio that included properties in British Columbia and Alberta. In reality there are a dozen or more RSL clubs in Sydney that dwarf these so called casinos, but that didn’t deter New World Gaming Partners. I can only assume they saw the group as a foothold into the continent and a good place to start, all for the bargain basement price of $1.37 billion.

Where it gets complicated is how the deal was structured. New World, despite their combined wealth did not finance the majority of the acquisition. In fact, Crown financials from around the time mention loans made to Gateway. The deal itself was highly complicated, and I’ll best leave it to Canadian business law publication Lexpert to break down –

The acquisitions were financed, in part, by multi-currency first lien facilities and a second lien facility provided by a syndicate of lenders led by Bear, Stearns & Co. Inc. and RBC Capital Markets, in their capacities as co-lead arrangers and joint book runners. Merrill Lynch Capital Inc. provided the interest rate and currency swaps with respect to the term loans.

You can find the rest of the article detailing it all here, as some less than enthusiastic local opinion here and a report from our own Australian media here.

Apparently local insiders scoffed at the purchase figures being thrown around, suggesting Packer and Macquarie were victims of their own inexperience and unbridled enthusiasm. But that seems unlikely given who we’re dealing with. However what followed did seem rather odd, even taking into account the impending Global Financial Crisis. A few years later, forbearance agreements were made and New World relinquished Gateway to an entity representing debtors- Catalyst Capital Group. This restructuring also meant Crown and Macquarie would no longer be liable for a billion dollars in debt. What’s strange is, the casinos were all operating well, despite the GFC and there was no apparent reason for massive money pit.

Financial statements or press records detailing exactly what went down are almost non-existent. However I did find an article from an anti-casino group, which you can read for yourself here. A grain of salt is perhaps recommended, but it does seem fairly legit.

Burnaby’s Gateway Casinos and Entertainment Ltd. morphed from being an income fund in 2007 to being owned by two shareholders: Crown and Macquarie Bank. Those two principals borrowed more than $1 billion from various banks, and in 2010 its proverbial chickens came home to roost.

A consortium of debt holders, led by Catalyst Capital Group Inc., started buying Gateway’s debts from those various banks and cobbled it all together.

Then Catalyst executives offered an ultimatum to Gateway principals on behalf of all the debt holders. Catalyst either wanted Gateway to pay off its debts or ante-up the lion’s share of the company’s equity.

That set the wheels in motion for the debt-holders to pay off $1 billion of the company’s $1 billion-plus in debt and provide a capital infusion of $100 million and a $500 million term loan.

In exchange, they got 98% of the company and were free to start racking up some new debt of their own.

From the same article –

“What was interesting for me was to see how these private equity investment firms go out and purchase the public debt with an eye to becoming management, basically becoming equity, and then going out and raising new debt for the enterprise,” said Lawson Lundell LLP partner Mandeep Dhaliwal.

“The debt-holders’ purpose was to take over the company and then go out and leverage the company again with new debt over time,” Dhaliwal said.

There simply isn’t enough information out there to ascertain exactly what the result of all this was. I don’t buy the suggestion they failed. Maybe creating debt to leverage debt was the plan. Or it could be all about selling short? After all, Star shares are among a tiny selection of Macquarie Prime offerings where shorting is allowed. Is this all part of the Macquarie Model?

Another school of thought relates to the de-merging of PBL. Crown shares hit the market in 2007. Perhaps nine casinos would be of some interest to potential shareholders. One thing is for certain, other than late 2013 / early 2014 the share price had never been as high as it was in December 2007.

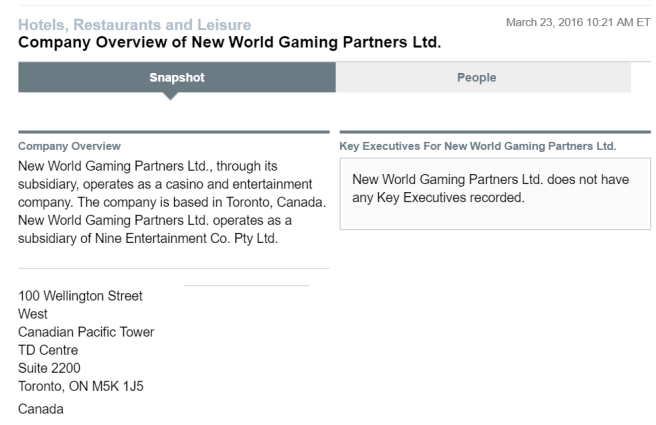

New World Gaming managed to retain a small percentage of Gateway (under 5%, obviously) and Macquarie still have involvement with the group as documentation agents as recently as 2013. Just to muddy the waters a little more, there is also now an entity known as Macquarie New World Gaming Canada Ltd which is listed as a controlled body and part of Macquarie (along with hundreds of other entities). However the original joint venture is not, and now exists and operates as a subsidiary of Nine Entertainment Co. Pty Ltd. I give up!

If any readers know a bit more about this please do get in touch as I’d love to find out more. Admittedly I was unaware of all this until a few weeks ago and to be quite honest I’m surprised this hasn’t had people talking, given everything else that’s been exposed or theorised. James Packer and Macquarie Bank! Tell me that’s not a match made in heaven. Or at the very least, a better match than James Packer and Mariah Carey!

A relationship that is much closer to home and far easier to break down is Macquarie and their interest in a large number of local bars and pubs around the country. Naturally, it’s a somewhat complicated web of ownership not easily distinguishable at first glance. But as we discovered, on top of their casino interests, Macquarie also has reaps in dollars thanks an interest in a group that operates 4% of the gaming venues Australia wide that hold 6% of the countries pokie machines – figures that may even need updating considering 30 additional venues are in the fold since those numbers were published. The fact remains, this group is the largest owner of pokie machines in the country, with 12,000 in their venues.

Australian Leisure & Hospitality Group (ALH) “help people live it up at their leading portfolio of 328 licensed venues across Australia” according to their website tagline. ALH is of course, the large Woolworths owned pub group that operates a number of large, suburban pubs that cater for the whole area and often promote themselves as being family friendly such as The Ranch in North Ryde, the Caringbah Hotel, The Family Inn Rydalmere and the Blacktown Inn.

What does not make for such cheery marketing material is the fact that ALH operations appear to be skewed towards areas of lower socio-economic status. It’s well known that a highly disproportionate percentage of overall pokie machine profits come from disadvantaged suburbs. For example, in Sydney the Fairfield area is ranked as the cities most disadvantaged according to the Australian Bureau of Statistics. The gaming industry makes $300 million per year in this area, with residents wagering $1.2 billion more than they were 4 years ago. In Fairfield the Cambridge Tavern and Brown Jug Inn are ALH pubs with the Villawood Hotel, Club Tavern Liverpool, Mt Pritchard’s Pritchard Hotel, Smithfield Tavern, Chester Hill Hotel, High Flyer Hotel Condell Park, Golfview Hotel Guildford and Hume Hotel Yagoona all ALH pubs within a couple of kilometres.

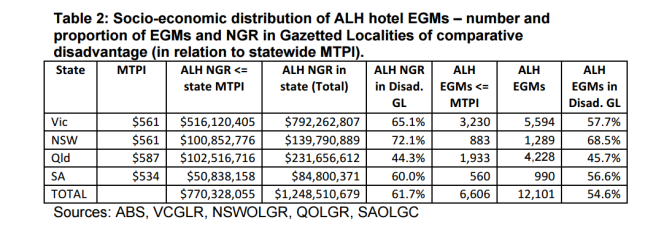

In a report commissioned by activist group GetUp!, Dr Charles Livingstone of Monash University confirmed this trend, finding that 61.7% of ALH’s net gaming revenue was sourced from disadvantaged suburbs – with the most extreme example being NSW at 72.1%. As per the report –

“Overall, ALH’s operations appear to be skewed towards areas of relative disadvantage, noting that 61.7% of NGR is sourced from disadvantaged suburbs. The most extreme such example is NSW, where 72.1% of NGR is sourced in disadvantaged areas. This arises from the distribution of ALH’s EGMs, 54.6% of which are located in disadvantaged suburbs. Again, the most extreme example of this is NSW, where 68.5% of EGMs are located in such disadvantaged areas. The situation in Queensland is atypical of ALH’s pattern of operations in that 44.3% of NGR is sourced from areas of comparative disadvantage, reflecting the location of 45.7% of ALH’s EGMs in such areas. This is likely to be an artefact of the Queensland liquor licensing regulations, which require sales of packaged liquor to be tied to hotel licences. This would tend to require operators wishing to sell packaged liquor to balance their hotel acquisition program more strongly towards liquor licensing considerations than is the case in other Australian states.”

You can read the full, nationwide report here. As you can see net gaming revenue is well in excess of $1 billion. All fairly disturbing reading, which makes you wonder why Pubtic were so quick to defend them considering their recent “reports” and articles on the casinos.

What does any of this have to do with Macquarie? Macquarie is the lead manager of ALE Property Group and holds and/or controls a vast number of the companies stapled securities – thanks mainly to their involvement in Fosters float and sale of ALH over 10 years ago. Not content with already profiteering to tune of $100 million, as rumours at the time suggested, they have controlled ALE and turned it into an enormous asset, valued by Urbis at well over $2 billion dollars.

What does ALE have to do with ALH you ask? In short, everything. ALE has a very simple business model. “ALE Property Group (ASX:LEP) is the owner of Australia’s largest portfolio of freehold pub properties. All of the properties are leased to Australian Leisure and Hospitality Group Limited (ALH) for an average initial term of around a further 13 years.” That is all. ALE, controlled and heavily invested in by Macquarie exists solely to act as landlord for the ALH venues that gouge millions from disadvantaged areas. They’ve seen fantastic results and have big plans for the future.

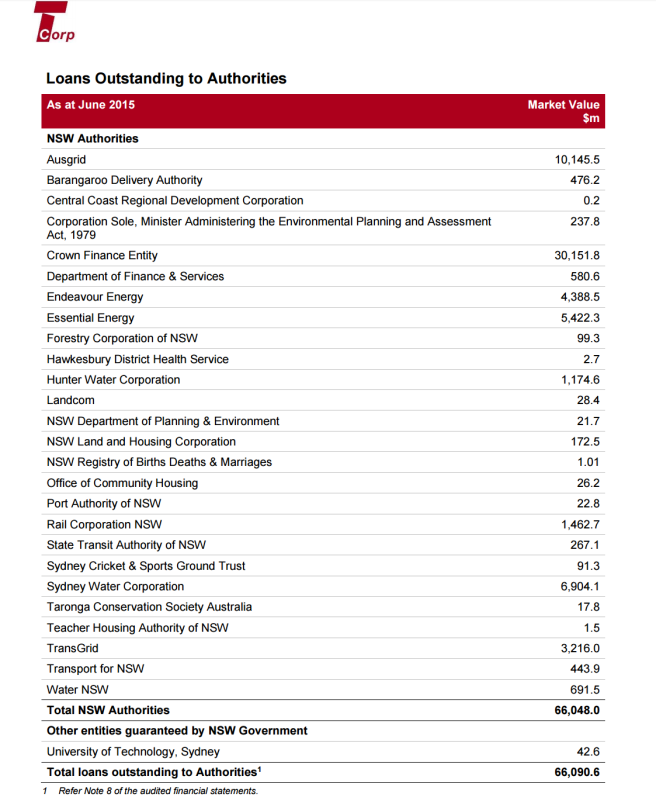

Peter Warne has had a long and successful tenure as chairman as ALE and was recently appointed as the successor to retiring Kevin McCann as chairman of the Macquarie Group and Macquarie Bank. You don’t get a gig of that magnitude without doing something right along the way! Warne also holds a chairman position at OzForex Group and is a director of the NSW Treasury Corporation, who are the central financing agency for the New South Wales public sector. TCorp also acts as a manager of asset and liability portfolios, providing financial risk management and investment management services to the NSW government and its constituent businesses.

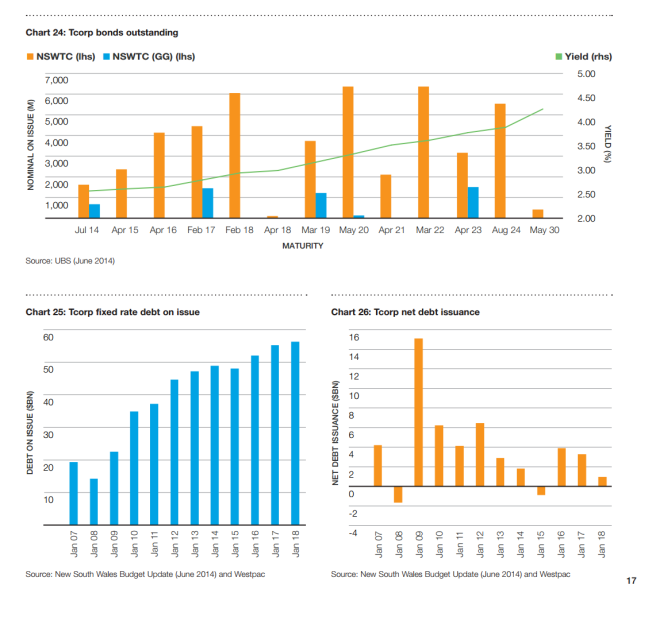

As you would imagine, Macquarie is a member of the TCorp dealer panel and therefore funds a number of government initiatives. Since the 2015 election, a $70 billion amalgamated funds management group for NSW Government agencies has been established, combining the funds management activities of TCorp, State Super and Safety, Return to Work and Support. Good to see our public service workers and police have their financial futures in such good hands. TCorp is also quite fond of what they call “hour glass funds”, which is an interesting choice of term given the likeness to the political and economic term – hour glass economy…

As of June 2015 last year, TCorp had loans outstanding to various authorities including the NSW Crown Finance Entity (as per 2014-15 annual report) and the currently up for sale Ausgrid. Others that make the list are Barangaroo Delivery Authority and the Sydney Cricket & Sports Ground Trust – two authorities who are currently in the thick of very controversial dealings. Barangaroo, of course is the site of Crown Sydney and the SCG Trust is fighting battles on multiple fronts. More on them to come.

When asking the question “who really owns this city?” Macquarie is a good bet. Not only do they have an interest in the Star, a strong relationship with James Packer and a large interest in a large percentage of the states pokie machines – they also control incoming funding to government authorities. It’s easy to ascertain, when Macquarie Bank speaks, Macquarie Street listens. But they’re not alone in calling the shots, and in our next article we will be revealing just who else holds the power in New South Wales.

Spoiler alert – it is certainly not the voters or the government.

The content on the website is the opinion of the writer, not intended to malign or cause or cause harm, either perceived or actual in any form including but not limited to emotional, financial, physical, social, mental or through status to any individual, company, organisation, religion, ethnic or social group. All opinions are that of the writer alone and do not represent any other party.

Permission to republish any content must be granted by the administrator of surelynot.live as per the Copyright Act 1968 and all relevant amendments et cetera

surelynot.live 23.3.2016

If you are a journalist/website/blog/any other format and would like to discuss the original investigative work, concepts, research, analysis and content on http://www.surelynot.live please contact admin@surelynot.live

2 thoughts on “The War Against the Machines”